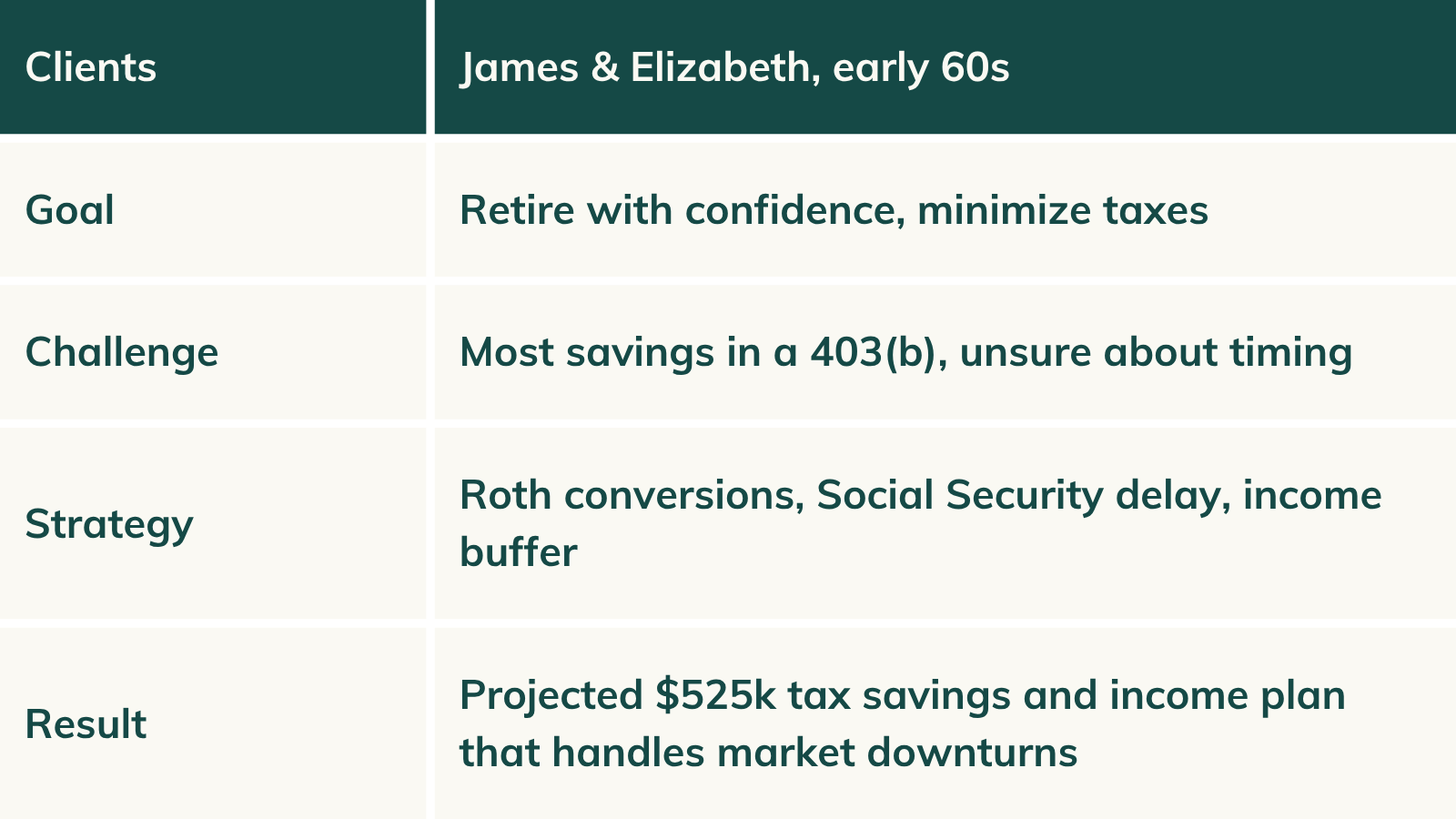

How One Couple Built a Tax-Smart Retirement Plan—and Saved $525,000 in Taxes

Meet James & Elizabeth

When we met in early 2020, James and Elizabeth (names are changed for confidentiality) were like many couples approaching retirement: unsure about timing, concerned about taxes, and trying to figure out what “retirement ready” really meant.

James, the higher earner, was still working in his early 60s and earning a strong six-figure income.

Elizabeth had already retired and started collecting Social Security at 62.

Together, they had just over $1 million in pre-tax savings, mostly in James’ 403(b).

They weren’t looking for a product or prediction.

They were looking for a plan they could trust—and one that would hold up when the market didn’t.

The Problem: Not Enough Time to Recover from Mistakes

Ten years earlier, James would’ve treated a market dip as a buying opportunity.

But now, nearing retirement, he couldn’t afford a major drawdown at the wrong time.

He knew one thing:

He didn’t want to build his retirement on guesses.

That’s why our first step together was about protecting the only thing that really matters in retirement:

→ Their ability to maintain their lifestyle, no matter what the market does.

The Plan: Build a Retirement War Chest and a Tax Strategy

We began by transferring James’ 403(b) into an IRA through an in-service rollover—giving us more flexibility for income planning and Roth conversions.

Then, we worked together to build a plan focused on three key areas (below).

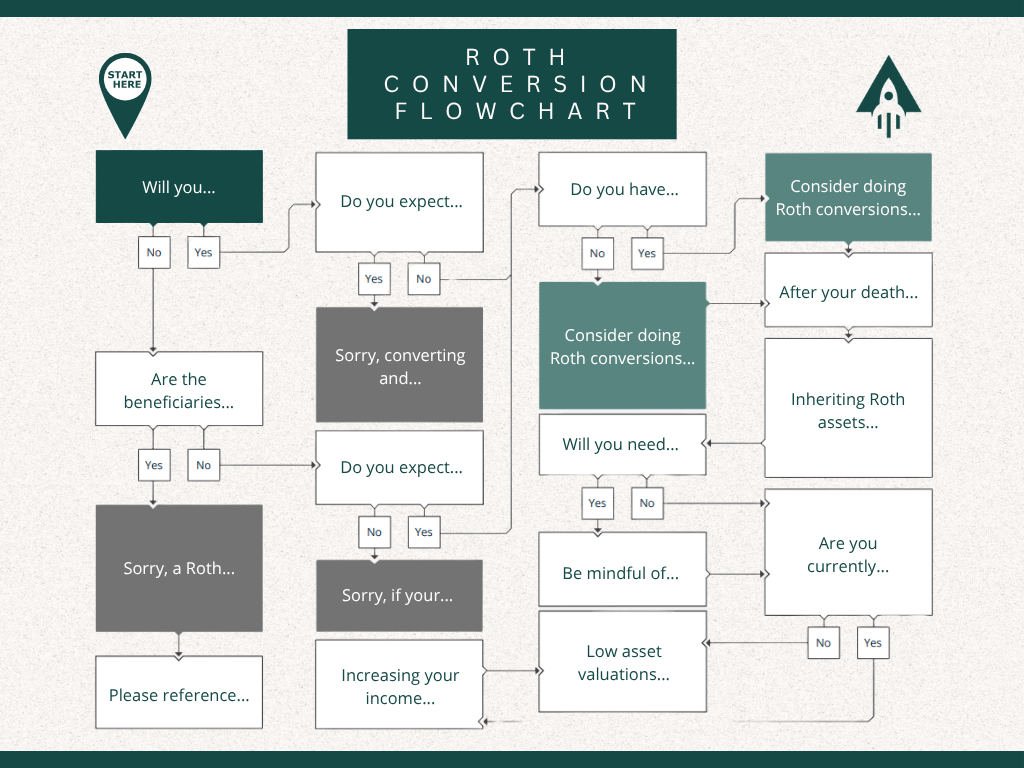

Want to Know if A Roth Conversion Could Work for You?

Download our simple flowchart to find out👇

1. Income Protection: Building a Retirement “War Chest”

James would need about $100,000 per year from his portfolio in the first five years of retirement. To protect that income from market volatility, we set aside $500,000 in very conservative, stable investments.

This became their retirement war chest—a buffer that would let them draw income confidently without touching stocks in a downturn.

If the market went up? Great.

If the market dropped? Their lifestyle wouldn’t.

2. Social Security Timing: A Strategy With Purpose

Elizabeth had already started benefits, but James wasn’t sure when to claim.

We walked through the tradeoffs together. In the end, we chose to delay James’ Social Security:

His benefit would grow each year he waited

Elizabeth’s survivor benefit would also grow in the process

It gave us more room for Roth conversions at lower tax brackets

This wasn’t just about maximizing benefits—it was about building in protection for the future, including the possibility that James might pass away first.

3. Roth Conversions: Smart, Intentional, Tax-Aware

We built a Roth conversion strategy that was deliberate, not aggressive—moving just the right amount each year to manage future taxes without triggering problems now.

We were especially mindful of:

Avoiding Medicare IRMAA surcharges, so they wouldn’t pay more for their healthcare

Using the gap before RMDs start at age 73 to shift money into tax-free accounts

Reducing their future taxable income, making their Social Security less taxable down the road

The projected impact?

A potential lifetime tax savings of $525,000.

And we didn’t need to guess—we had the plan, the projections, and the flexibility to make small course corrections as needed.

The Outcome: A Plan Built on Purpose, Not Predictions

James and Elizabeth didn’t just want to retire.

They wanted to retire wisely—with confidence in their cash flow, clarity about their taxes, and peace of mind about the future.

And now they’ve successfully retired without guessing, without scrambling, and without paying more tax than necessary.

Want to Know if a Plan Like This Could Work for You?

Every situation is unique. But if most of your savings are in a 401(k) or IRA… what could you do with an extra $100K, $300K, or even $500K (or more) in tax savings?”